Data Visibility Across the Institutional Investment Community

Comprehensive solutions that employ AI technology to help you collect, aggregate, distribute and understand complex data, seamlessly

Trusted by the Investment Management Sector

Many of the world's leading investment teams, asset managers and consultants choose Dasseti platforms to underpin their due diligence and data exchange requirements.

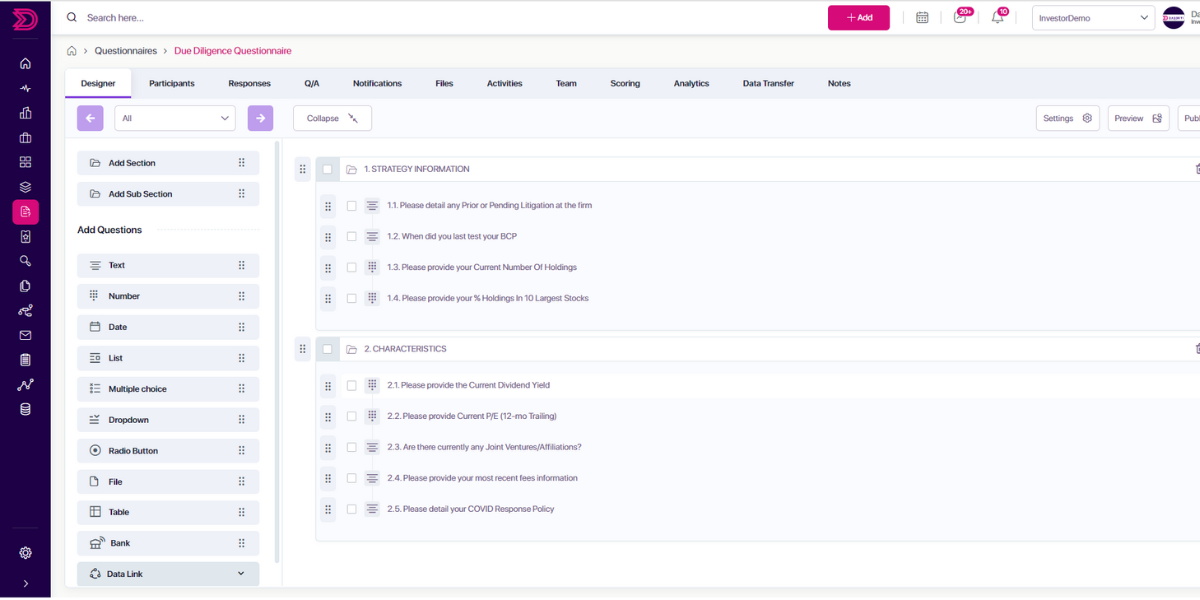

Collect and Compare Manager and Fund Data, FAST

Empowering your due diligence and research teams to better understand your managers, and funds in one central location.

- Create custom questionnaires specific to your need

- Monitor and track potential risks that may impact your portfolio

- Deep dive into managers, funds, or third parties

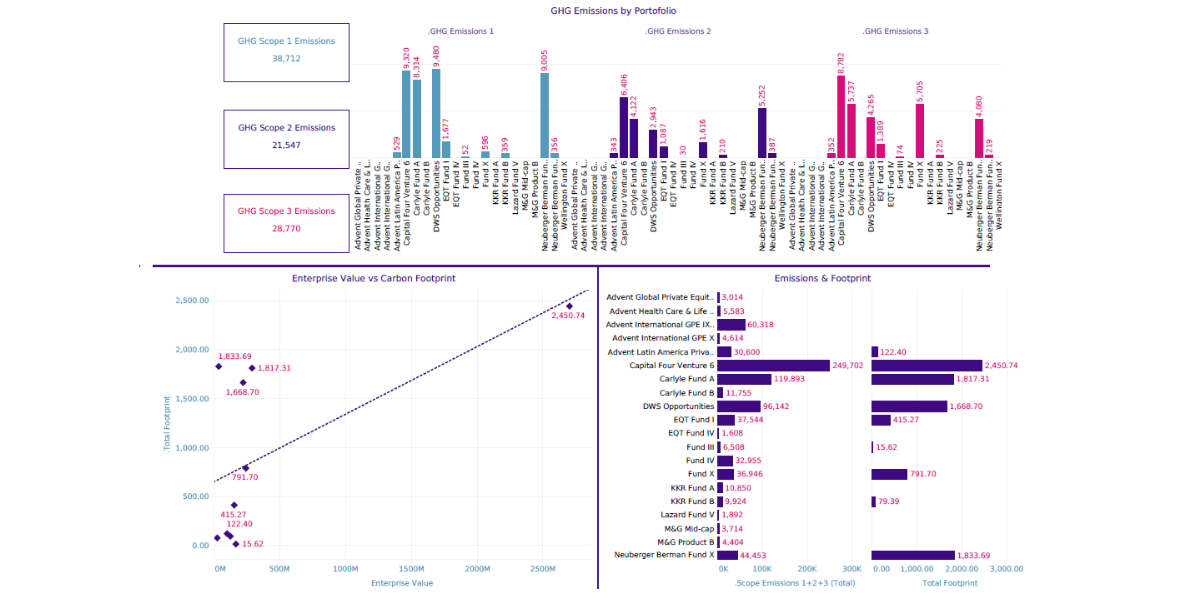

Collect and Analyze Private Markets' ESG Data AT SCALE

LPs, Fund of Funds, Direct Investors and GPs can now collect original fund and holdings level data directly from across private markets.- Own proprietary ESG metrics

- Fulfil reporting requirements and track progress against targets

- Inform investment decision making

Build Stronger Relationships with Institutional Investors EFFORTLESSLY

Meet the new investor relations tool that will help you build stronger relationships with your institutional investor clients and stand out from the crowd.

- Tell your best story to investors

- Reduce the amount of time on IR related tasks and spend more time building relationships

- Update your data once and share it across all databases

Case Study

Driving Efficiency with Dasseti Collect

Monitoring 55 Manager Universe | 2X Efficiency Gain | 4 Weeks to Results

Latest News

Dasseti Achieves SOC 2 Type 2 Certification

This achievement demonstrates Dasseti's commitment to providing enterprise-level security for client data.

.png)

Dasseti becomes one of the first ESG Data Partners in the ESG Data Convergence Project

The industry group is leading on a major ESG data standardization project.

What our customers say

“As we look to provide the best service to our clients, we have been observing the evolution of technologies in this segment for a while. We found that Dasseti was the best fit to our needs and their team aligned to our long-term objectives.”

“Working with the Dasseti team to implement the system has been a pleasure. Implementation has been straightforward and swift with good support from the team. The system itself is easy to navigate with the flexibility that we need. We have already captured some efficiencies from using the system and see greater application across our team.”

“From our initial interaction with the Dasseti Team and their willingness to work with us, challenge us and take on board our ideas, we knew we had the foundations of a great partnership that had the potential to radically change how we manage and process RFP's, DDQ's and Compliance questionnaires.”

“The team at perfORM selected Dasseti for its flexibility, and could clearly see how the platform could complement the ODD services we provide to a growing and diverse client base.”

Dasseti is award-winning

Dasseti has been recognized by the sector, as leading the fields of due diligence, ESG data collection and data management.

%20(1).jpg)

.png)

.png)