What is Investors Plan for H1 2021 Alternative Asset Allocation?

HFM, and the Alternative Investment Management Association (AIMA), the global representative of the alternative investment management industry, surveyed 65 investors (with US$3.8 trillion in total investor assets, US$156 billion of which is invested in hedge funds) and senior IR and marketing professionals from 135 hedge fund managers to discover the changes allocators plan for their portfolios in H1 2021. Here are some of the key findings.

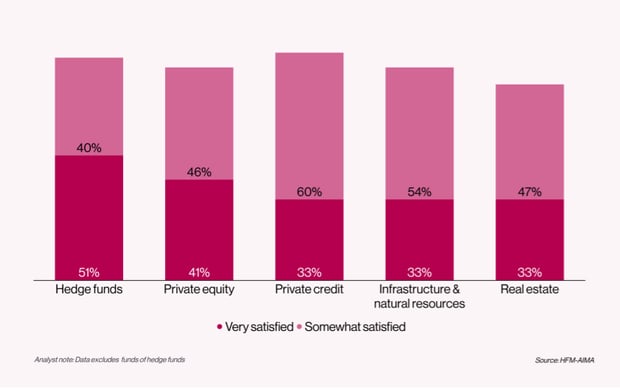

Over 90% of investors have been satisfied by private credit as well as by hedge funds investments’ performance in 2020.

Hedge funds exceeded investor performance expectations, and this will set the expectations for 2021 even higher.

Following the strong performance in 2020, the projections of a low equity market returns and ‘lower for longer’ interest rate environment, hedge funds are the asset class that most likely will see inflows in 2021.

Indeed, on top of the expectations of higher returns, investors listed few important reasons why they are considering increasing their hedge fund allocation in 2021:

- Equity valuation concerns

- Fixed-income replacement

- Private market illiquidity

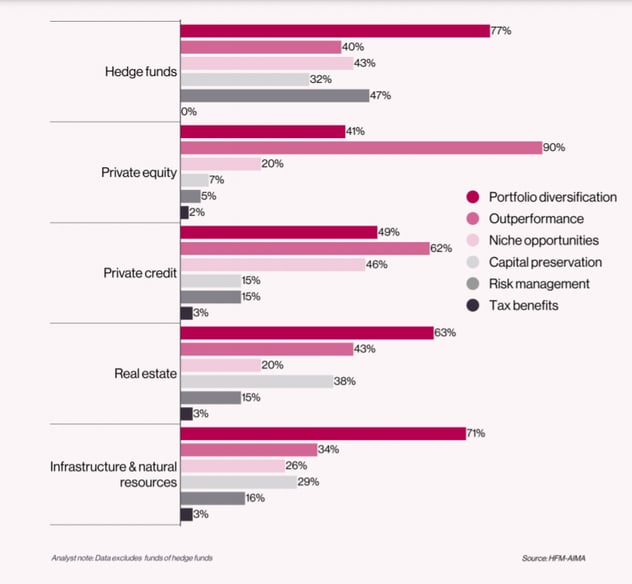

A turbulent 2020 pushed managing risk to the top of investment objectives in H1 2021. Enhancing returns take second place in the overall results. Combined, these two objectives foster a positive sentiment towards investing in hedge funds that have successfully managed risks in the volatile period of 2020.

Private markets remain attractive for their performance, whereas hedge funds are positioned high from a diversification and risk management perspective as well.

As for the hedge fund managers perspective for H1 2021, they are increasingly broadening their offering to include long-only and private markets products. Over a quarter of managers are already offering or planning to offer private credit funds.

Are you an investor eager to facilitate fund manager due diligence and reviews? Or a manager interested to streamline the process of responding to due diligence requests? Please contact us.

Data source: “Investor Intentions H1 21” Report. HFM and AIMA